Are you living abroad and want to support your family with their daily payments or an unexpected expense? Or perhaps a friend in another country is celebrating a birthday and you would like to contribute to a gift? Maybe the dog shelter in your hometown or another important cause is in urgent need of money? Are you wondering about the cost, timing, the amount received after fees and commission?

We get it - global transfers can be a hassle. Despite recent improvements, sending money cross-border still incurs an average fee of 6.35% of the amount sent. And this issue isn't limited to international transactions; local transfers can also come with inconveniences.

But there is some good news: thanks to the latest technology and increased financial inclusion, there are now ways to avoid these issues. One such solution is MyGuava Card Transfers.

In this blog, we answer all the questions you might have about it.

How Do Card Transfers Work?

You are likely familiar with sending money to someone’s bank account. Perhaps to email addresses or phone numbers. But what about card transfers?

Sending money to cards is a simple and efficient method of transferring funds from your account, your card or your mobile wallet regardless of the recipient's location. All you need is their card number and full name. Once you specify the amount, the funds are transferred directly to their card. The cutting-edge technology behind this process ensures that the money reaches the recipient quickly and securely.

Thanks to our global partner network and advanced payment processors, MyGuava facilitates real-time card transfer processing worldwide.

What Methods Can I Use To Send Money To Cards With MyGuava?

-

Account to Card: Transfer funds from your MyGuava Account to eligible cards globally.

-

Card-to-Card: Use your card to send money directly to another by entering both card numbers.

-

Mobile Wallet-to-Card: Use mobile wallets like Apple Wallet or Google Pay to send money to a card. Enter the recipient's card numbers and the system will prompt you to choose from one of your linked cards.

How Much Do MyGuava Card Transfers Cost?

It's common to encounter ‘free’ services that hide extra fees, but not with MyGuava.

Here’s a breakdown of what you will need to get started with card transfers:

1. Downloading the App: Free

2. Opening a multicurrency MyGuava Account: Free

3. Holding money in 20 Currencies: Free

4. Getting a physical or digital MyGuava Card: Free (optional)

5. Sending money to cards globally: Highly competitive and transparent fees

If you are sending money in a currency different from your account or card, you can benefit from our competitive and transparent FX fees. You will always know exactly how much you are paying and the amount the recipient will receive.

How Long Do Card Transfers Take?

Everyone is tired of waiting ages for international transfers and stressing over the money’s whereabouts. You can finally relax with MyGuava. Whether you are sending money across town or the world, it’s all done in a flash. Set it up, swipe to confirm and voilà – the money lands on the recipient’s card instantly.

Which Countries Can I Send Money To?

We are constantly working to make the world smaller to bring your loved ones closer. Currently, you can send money to more than 140 countries in over 90 currencies.

Are Card Transfers Safe?

Security is our top priority. We implemented two-factor authentication and are fully PCI DSS compliant, meaning we use the latest technology to keep your transfers protected from start to finish.

Send Money To Cards With MyGuava: Step-by-Step Guide

1. Open the MyGuava App and log in.

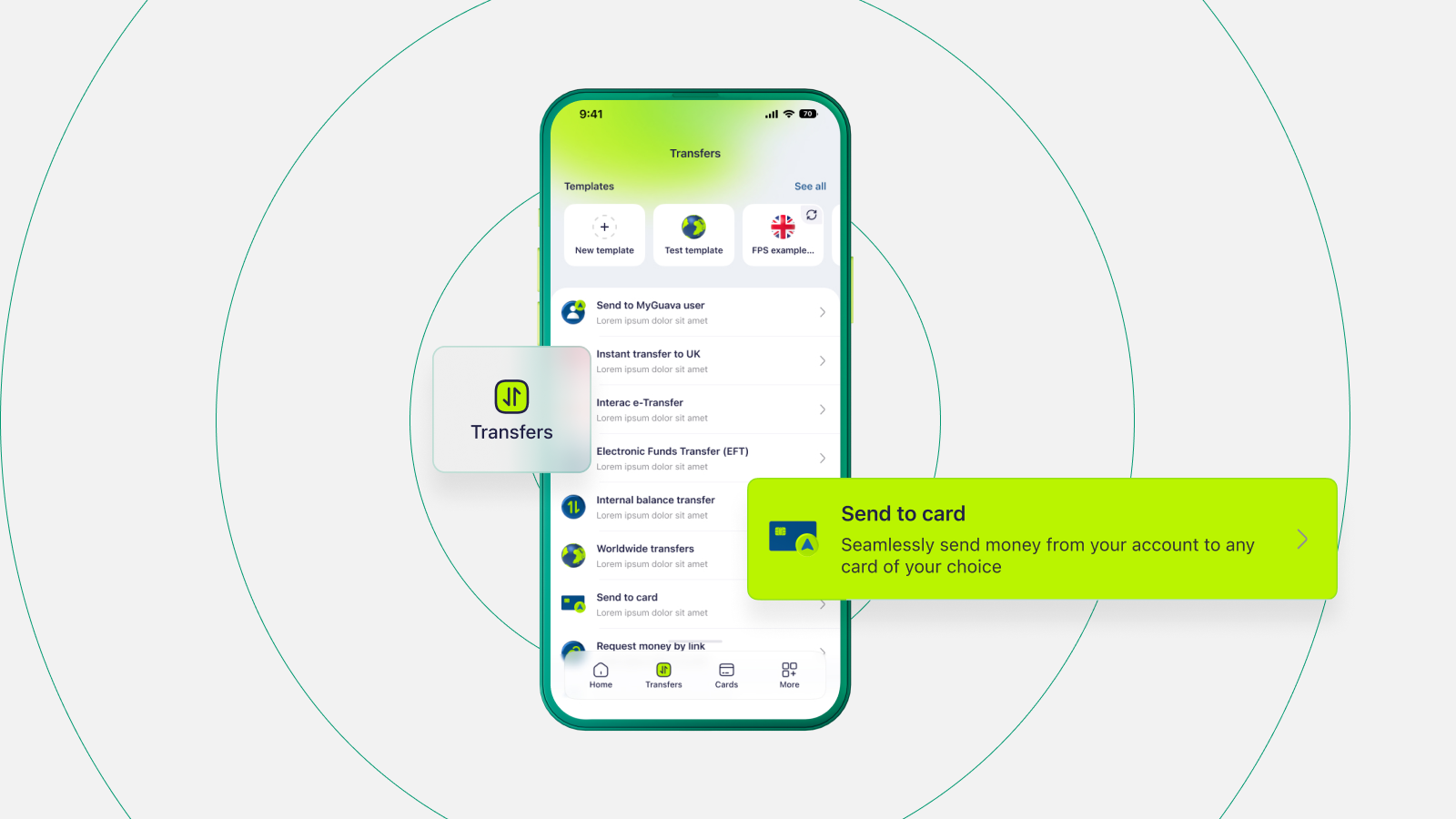

2. Tap on ‘Transfers’ at the bottom of the screen and select ‘Send to Card’.

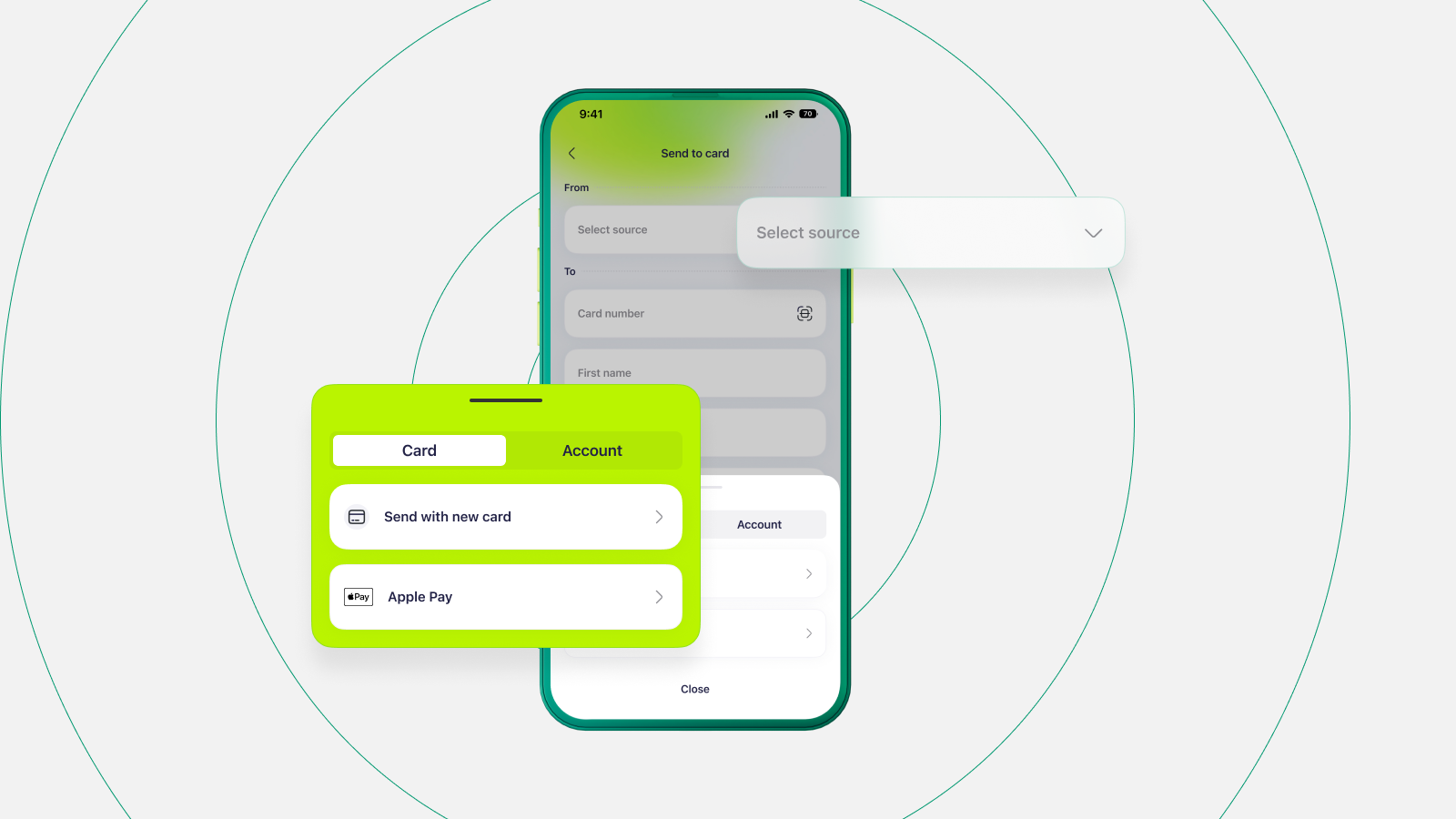

3. Tap on ‘Select source’ and choose your preferred method: a card, one of your MyGuava accounts, or your mobile wallet.

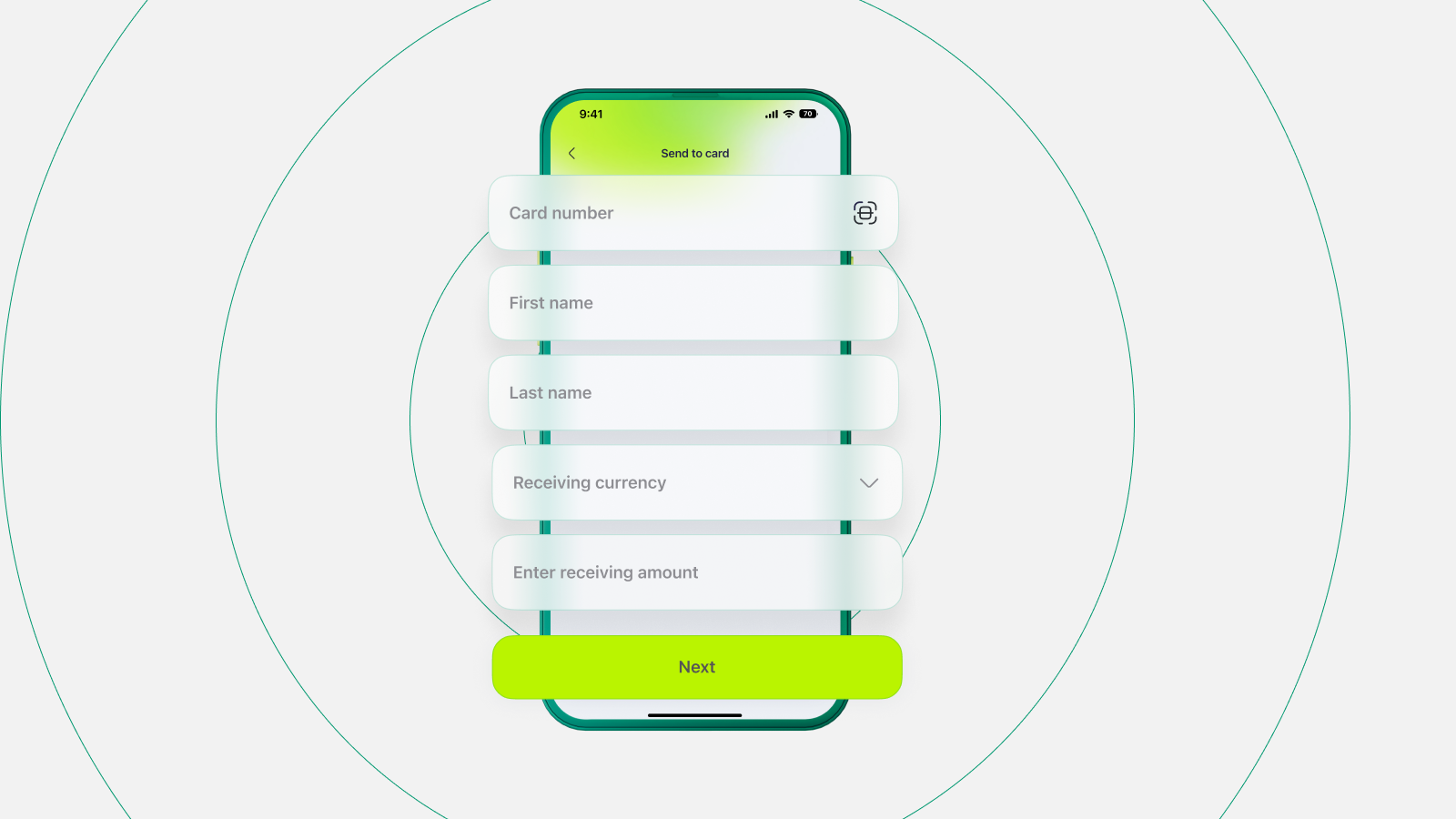

4. Enter the recipient's card number, first and last name, receiving currency, and the amount you want to send. Then tap ‘Next’.

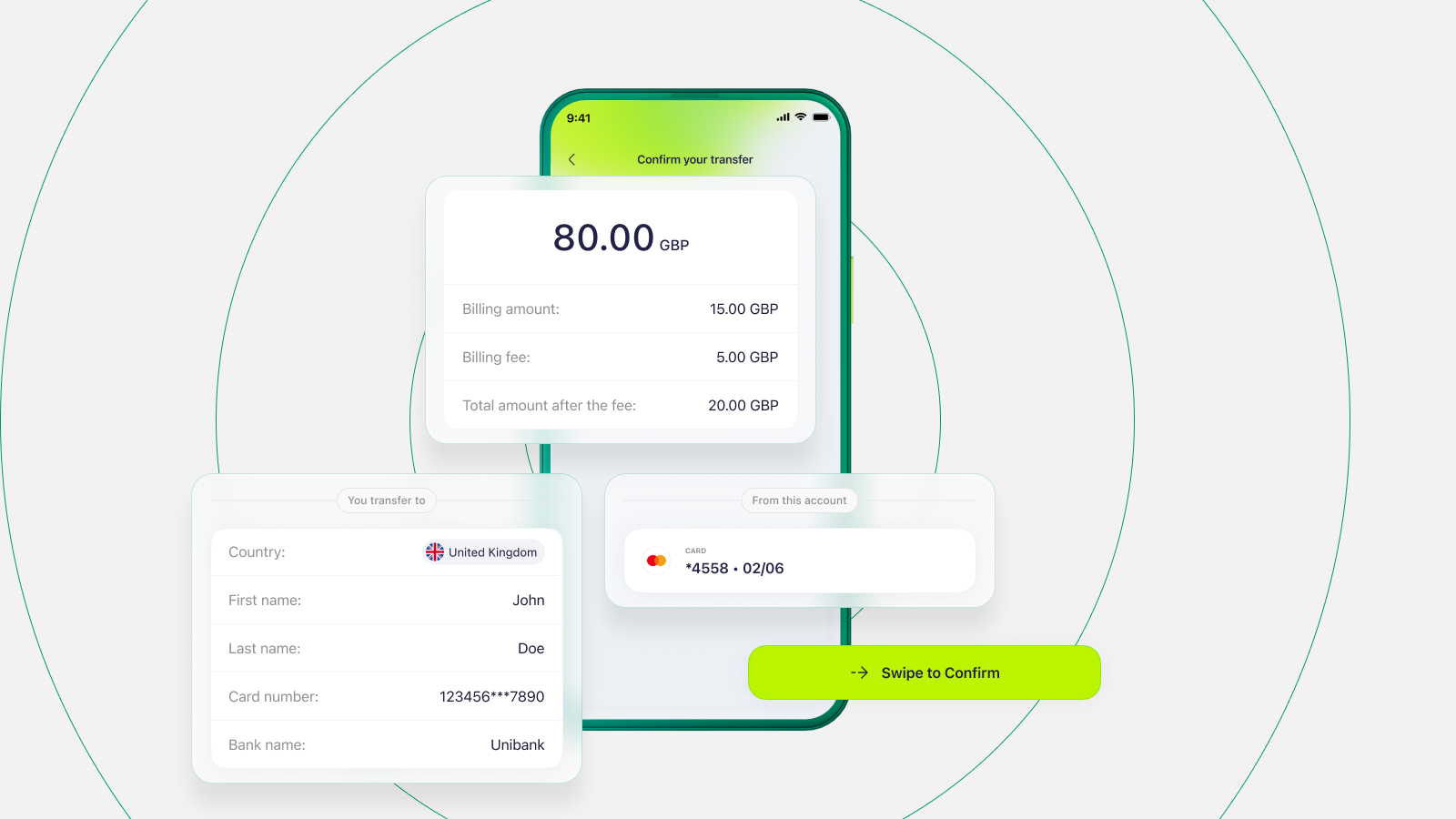

5. Review the transfer details, including the amount sent, the recipient's received amount and the fees (if there are any). If everything looks good, ‘Swipe to Confirm’ and watch your money reach its destination instantly.

Final Thoughts About Card Transfers

Card transfers are a game changer, making sending money locally or across borders quicker and cheaper than ever. With MyGuava, you get the full package: no hidden fees, instant transfers and advanced security measures. Whether you are sending a little love to a friend or supporting a cause close to your heart, we have got you covered.